Money that brings incredibly high interest to the depositor is the eternal dream of every owner of a free amount of money.

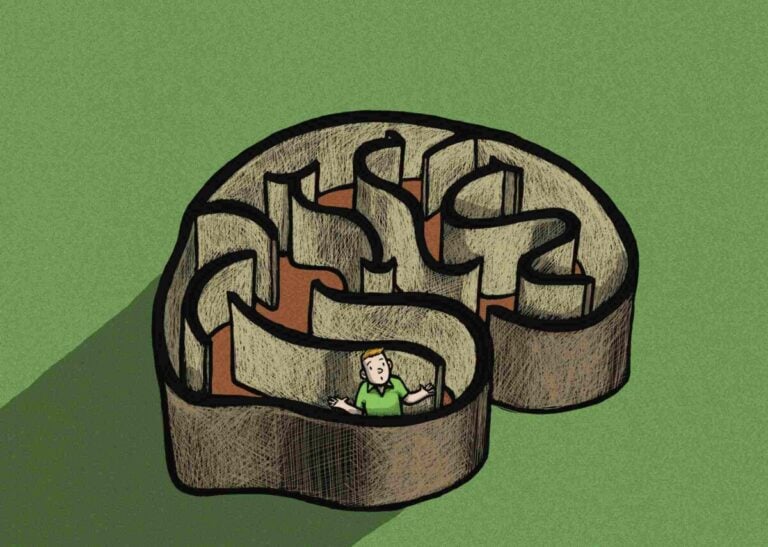

I invested $100, and a month later I received $1000 – for an inexperienced person, this seems simple. The reality is completely different: only a pyramid scheme can promise easy money. This article will reveal the scheme of activities of such organizations.

What is a pyramid scheme?

The classic scheme of defrauding investors “invest – get more” was often used in the 90s, and little has changed since then – different amounts of money are lured from gullible citizens, promising to return the investment with large interest – however, instead, the organizer (organizers) ” businesses” take investors’ money and hide, periodically opening similar “butterfly firms”.

Types of financial pyramids

Hype project in its natural form

There are cases when the organizers of the pyramid do not hide the meaning of their work – luring clients into the network, providing convincing explanations of the scheme and demonstrating logical calculations. “Due to the Internet, we have access to more partners, so this business is even more successful than before” – one of the favorite arguments of the shadow “businessmen”. “Be one of our first investors – earn millions” is another slogan that is widely used to attract new investments.

Super-profit investment pyramid

Most scammers do not call their activity a pyramid scheme so openly – most often they present themselves as an investment enterprise. Loud, attractive names: a promising business, a high-tech company, an innovative project – are the key to the success of scammers. Often there are offers to buy shares, cryptocurrency, real estate, land, invest in IT business, gold mining – there are many options. No risks – only “sky in diamonds”.

Soap bubble under the guise of a reliable company

Another common option is that scammers disguise themselves as other companies, for example: management companies, consumer cooperatives, bookmakers, etc. At the same time, potential clients will not always be offered to invest money, it can also be buying a cruise trip at half price, cashback for buying gold jewelry, or even repaying a loan if the client brings other debtors to them.

Most of the pyramids work only on the Internet, but there are those that combine live and online communication. Such firms lure with bright advertising, splurge in beautiful offices, lure them into various groups on social networks.

How to recognize a pyramid scheme?

Still, scammers can be recognized by a number of the following signs:

- Guaranteed high income without any risk: active advertising of the organization and public statements about exorbitant income ten times higher than the established market norm are lies, because any self-respecting investor knows that such statements are prohibited in the financial market. However, HYIP projects, as a rule, do not disdain to openly declare that their business product is supposedly extra profitable and even cite many formulas to prove their words, which even an experienced financier cannot figure out – of course, all this is done in order to confuse investors.

- Ask to Refer New Clients: For each attracted client, they are promised a percentage of their contribution, which allows criminals to successfully involve as many people as possible in their plausible scam, steal their money and successfully leave them with nothing.

- Proof of investment is missing: beautiful presentations flash before your eyes, and documents confirming the stunning facts, as there were, and are not. Money is often offered to be sent not to the details specified in the contract with the company, but to the account of a legal entity or they are asked to make a transfer to a bank card; no less popular is the option of transferring by the phone number of an unauthorized person or depositing in cash: no documents are issued. All this is done to hide the traces of the transaction: without confirmation of the investment, it is difficult to open a criminal case and find swindlers.

- You can’t find contact details on the company’s website: usually no phone number or email address. You can only communicate with the manager or request a call back. Only fraudsters need to hide contact details – without this information it is very difficult to find and prosecute the perpetrators.

Famous financial pyramids and their founders

Speaking of HYIP projects, one cannot fail to mention the most famous of them – world history is replete with examples when people from the middle class, using cunning tricks, managed to earn thousands or even millions of dollars from scratch. The most notorious pyramid schemes whose activities have been exposed include:

- The Securities Exchange is a company that was founded in 1919 by an emigrant from Italy, Charles Ponzi. The essence of the scheme was as follows: an investor, investing $1,000 for 3 months, could count on a 50% profit. But where does the company get the funds to pay such a decent “fat”? Of course, from the contributions of new investors! In 1920, the company ceased to exist, however, its founder managed to pocket about $ 20 million – a colossal amount for those times. The Ponzi scheme is considered a classic, and therefore other pseudo-profitable financial HYIPs originated from it;

- Madoff Investment Securities – founded in 1960 by Bernard Madoff, the company is an example of a classic Ponzi pyramid – money to investors was also paid from funds from new investors, but it was already about 12% per annum. According to a rough estimate, the amount of losses of investors from the activities of the company is about $65 billion;

- The most famous pyramid scheme in the CIS MMM, the founder of which is none other than Sergey Mavrodi, somewhat departs from the classical scheme, although it retains its elements: for example, instead of extorting money from investors directly, MMM offered civilians to buy their own shares of the company, which allegedly grow in price almost every minute. These were the 1990s, and advertising promising investors 1,000 and then 3,000% per annum simply could not help but attract the attention of the inhabitants of the Iron Curtain, who had not known anything about such fraudulent schemes before. According to official figures, the number of people affected by MMM reaches 15 million, and the total amount of damage is about $2 million;

- Another example of large-scale depositor fraud is Stanford International Bank, which its founder, Allen Stanford, carefully disguised as a reliable bank. The scheme is similar to MMM Mavrodi, but instead of shares, they offered so-called certificates of deposit – in fact, it was the same deposit, but with much more favorable conditions than in other legal banks.

- There are cases when the activity of the financial pyramid does not meet with the resistance of the authorities. This happened with the Romanian company Caritas: in a short period of existence (1 month), this organization managed to deceive investors by $1 billion. The company’s founder, John Stoica, had good relations with the mayor of Cluj, Georg Funar – the latter rented part of the city administration building to house Caritas offices.

What is the danger of financial pyramids and why is this type of business difficult to close?

As mentioned above, most fly-by-night companies that promise excess profits to customers lack both a permanent legal address and documents that could in any way lead to the trail of intruders. Victims of such investment schemes, turning to law enforcement agencies, cannot even prove the fact of investing funds, because, as a rule, they have no evidence.

The investigation does not guarantee a positive result: catching a ghost company that changes its location is a protracted and unpromising occupation. There are cases when, for the sake of a “profitable investment”, people had to sell their homes and other valuable property – the news of the closure of the “ghost” for such investors became a real blow: the police recorded several cases of suicide.

How do HYIPs hook investors?

With the development of information technology, it has become much easier to attract a gullible investor to a network of falsely profitable investments – you need to follow simple rules:

- place ads on the Internet, public transport windows, etc.: this will attract more customers;

- mass SMS mailings with attractive content: profitable interest on a “deposit” from a “reliable” bank is the main essence of spam mailings from fake organizations masquerading as eminent Finns. institutions. Truth in these mailing lists is exactly 0%;

- show off beautiful stories, convincing calculations without documentary evidence: “true” success stories work flawlessly on incredulous customers;

- acquire “real” documents to confirm the legality and reliability of the company: insurance against suspicion is the key to the success of such “funds”;

- Renting a chic office in the city center: image is a reliable ally for blunting vigilance: it creates the illusion of stability and reliability, but in fact it is the scenery of a well-played spectacle;

- The amount of the deposit does not increase immediately: you can convince the client of your honesty by offering to invest not the amount to begin with: the depositor, making sure that the payments have actually been received, invests the amount more, not knowing what “prospects” await him;

- in addition to investments, depositors can also be offered to pay for membership in a club (fund): the contributor will receive certain deductions while he is a member of the fund (club) that accrues payments to its participants: you need to make a certain amount (donation), sign an agreement – after which the deductions will begin to flow into the investor’s account. Often, such funds exist for a short time to change locations and contact details.

How not to get into a financial pyramid?

The first step is to look at what the organization does. If it is registered as a bakery, but offers investments in cryptocurrency, then these are probably scammers.

It will not be superfluous to study the reviews of previous customers. Lots of the same rave reviews? They are not written by clients, but by commissioned copywriters. First of all, it is necessary to verify the full name, details of the company specified in the contract and on the website of the organization. Even the smallest difference can indicate the uncleanliness of the company. It is worth familiarizing yourself with the obligations that the company assumes and information about what will happen if the company fails to fulfill these guarantees. No such information? The company should not be contacted.

Do not rush to sign the contract – it is better to immediately carefully read the terms, and if there is a suspicion – it is better to quit this venture or postpone it until a conversation with a lawyer.

A profitable investment with attractive interest rates and a short term for accruing profits is a myth that has nothing to do with reality. Beautiful promises, convincing arguments, and even “official” documents are part of a carefully thought-out performance called “customer care”: in fact, the founders of the pyramids care about only one thing – their own financial well-being, skillfully use the desire inherent in every person to avoid financial problems, to ensure your own security in the future. By entrusting money to scammers, investors risk both financial and spiritual well-being – a fleeting delight from a profitable offer quickly dries up, leaving behind a feeling of bitter disappointment and loss.

You can avoid this if you are attentive to too attractive offers – no one will take care of the well-being of another to the detriment of himself: actually paying the promised interest to depositors, such “generosity attractions” would last no more than a month – there are numerous examples when such organizations managed to stay afloat for more than a decade and inflict serious losses on depositors. Of course, the scam is revealed and the organizers end up in jail – the question is how soon this will happen and how many people will have time to suffer as a result of the actions of the dishonest founders of the “virtue funds”. It’s nice to get twice as much money by signing an agreement and investing the amount – but it’s even nicer to realize that you have not become a victim of a sophisticated deception.