Exchange-Traded Fund (ETF) – a literal translation of “exchange-traded fund”, sometimes called in simple terms an exchange-traded fund. The company that creates it is usually called an ETF provider. It can also be called a management company. Most often, he has several funds.

Features

There are three foreign providers that are the largest. These are iShares, the second name is BlackRock, State Street Clodal Advisors, Vanguard. There are also not so big ones. Among them are PowerShares, Invesco, Wisdom Tree, SmartETFs, Renaissance, Harttord and a number of others.

Most often, the fund’s assets are represented by shares and bonds. But there are also funds that invest in the production of goods and in raw materials (Commodities). Real estate investments are made by ETFs called REITs. They also invest in other assets, including volatility or the fear index.

The ETF provider does not own the assets and money of investors. All assets are kept in separate accounts. That is, investments are protected from errors or abuses of the management company. An additional protection is an auditing company that checks the fund’s accounts and controls its actions.

Another mandatory element of an ETF is a registrar company. She handles the registration of ETF shareholders. The liquidity of an ETF is handled by a market maker. Most often it is a broker. He is in the order book, places orders (purchase and sale of the fund’s shares). Without a market maker, a massive buying and selling of the fund’s shares can greatly shift quotes, and the price will not be fair.

How ETFs work

Let’s say someone wants to buy stock in the S&P500. But it would take a minimum of $10 million to acquire the entire index. In addition, you will have to spend money on commissions. But there are ETFs that have already purchased these shares, and in the same proportion as in the index. In this case, you can simply purchase an ETF share, thereby becoming the owner of a piece of the index. The fact is that the value of these shares is determined as the result obtained after dividing the total value of net assets (shares, bonds that the fund bought) by the number of issued shares.

If the index falls, the price of the ETF also falls. This means that when buying exchange-traded funds, you should remember about diversification. When purchasing a broad market index, it must be balanced with a bond or gold index.

Another important feature of the ETF is the way the fund copies a ready-made index, in which it does not need management costs and complex analysis. For this reason, the ETF has minimal commissions, we are talking about hundredths and tenths of a percent. That is, the ETF has a greater benefit than other actively managed funds, since the fee in them can reach 5% per year.

If we talk briefly about what an ETF is, then we can call it an exchange-traded fund, passively following the index and copying its composition. Since the diversification is wide, non-systemic risks that are caused by the fall of any stock or the bankruptcy of the issuer disappear. As markets tend to rise, so do ETFs.

The best time to buy ETFs is when you’re diversifying your country or industry. This is especially true for beginners or those who do not want to engage in deep analysis of individual stocks.

When using ETFs, one click is enough to invest in any indexes. For example, in the Moscow Exchange S&P500, Nosdaq, EuroStoxx, the MSCI World stock index, which includes more than 1600 stocks of countries around the world.

Pros and cons

ETF Benefits

For the better, the ETF highlights the following:

- fund shares are freely available on the exchange, they have very high liquidity, all transactions in such shares are very fast;

- the degree of costs is small, commissions are significantly lower than in other funds;

- shares are sold at a low price, in the Russian Federation the minimum value is 500 rubles, in Western countries – 50 dollars;

- thanks to simple management, you can not deal with the selection of assets and portfolio balancing, it is enough to purchase 3 – 4 different ETFs per account;

- there are quite a lot of funds, there are ETFs for bonds, stocks, commodities, and so on;

- It is possible to collect a well-balanced investment portfolio, provided that the available amount is small;

- There are many ETFs that pay dividends;

- The presence of tax preferences is of no small importance.

The main advantage of ETFs is the growth in the value of shares in the long term. Despite crises and market crashes for 15-20 years, ETFs have a yield of 6 to 12% per year.

Cons of ETFs

- when stock indices fall during a crisis, stock ETFs also fall;

- Investor returns are in line with market averages, as this ETF is equal to the growth of the index;

- when bonds and gold are included in the ETF package, due to diversification, the total income will be lower than the average market, however, this will provide protection from the crisis;

- Russian citizens have access to foreign ETFs only if they work with foreign brokers, there are very few ETFs and mutual funds on the Moscow Exchange, while the most important index funds are not among them.

ETF returns

As with anything when it comes to stocks, there are two ways to make money with ETFs.

- Acquisition at a lower price than a subsequent sale. ETFs rise and fall at the same time as indices, but rises more often.

- Almost 80% of funds located abroad pay dividends. In Russia, only funds from ITI Funds do this.

ETF dividend sizes vary by fund. For example, iShares Core High Dividend ETF, investing in stocks with the highest dividends, makes quarterly dividend payments. Its annual yield approaches 6%. SPDR makes dividend payments once a year. Its yield approaches 2%. There are ETFs that pay dividends every month.

Types of ETFs

When classifying exchange-traded funds, the underlying asset is usually taken into account.

Stock ETFs

Here, the underlying asset is the shares of a particular industry or stock index.

They are divided into subspecies:

- broad market – covers most or all of the companies or industries that exist in the country;

- for companies with small, medium and large capitalization;

- for companies that pay the highest possible dividends;

- on the shares of companies with a well-marked growth;

- Emerging and developed market stocks

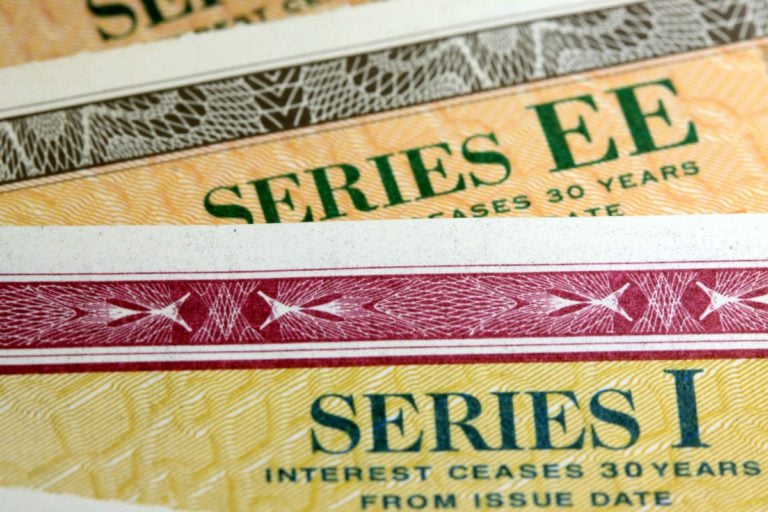

ETF on bonds

These funds invest in the following assets:

- short-term, long-term and extra-long-term government bonds;

- bonds that are corporate;

- high-yielding (junk) bonds;

- an inflation-linked bond;

- mortgage bonds.

ETF to Commodities

- for the most protected asset – ETF for gold;

- also a protected asset – precious metals;

- oil;

- real estate.

Other types of ETFs

- called inverse, growing when the index-benchmark falls and falling when the index rises;

- Having leverage, for example, 3x, at which ETF stocks rise or fall three times as much as the existing index;

- alternative – for example, there is an ETF for the Harry Potter index, created by StockPickr, (it gives you the opportunity to participate in the success of the famous film “Harry Potter” by investing in shares of film producers), and you can also invest in companies that are related Franchise ETF SHE, is a cluster of companies with a female board of directors.

Fund liquidation

It happens that ETFs close. There is no danger here. For the market, although this situation is abnormal, there is nothing unusual in it. The provider that decides to dissolve the fund informs about a specific date in advance. After that, the investor can make a choice:

- he has the opportunity to sell shares at the price that exists on the exchange;

- can wait for liquidation to begin by receiving a refund. The closing price is calculated taking into account the amount of the fund’s assets.

The first option is more preferable. When waiting for liquidation, you can make a mistake with the exact price, and the money will be transferred for some time (sometimes several months).

How to choose an ETF

This investment has a number of benefits. If the distance is long term, ETFs are 95% more profitable than hedge mutual funds. So it is better to invest money for 10-15 years.

ETF Portfolio

For a novice investor, it is best to acquire the simplest portfolio of five components with equal proportions:

- acquisition of American shares (SPV or QQQ, Moscow Exchange, global share index, etc.) is possible;

- bonds that are short-term (Short Term Treasur, SHV);

- long-term bonds (Long-Tern Corporate Bonds);

- for gold;

- real estate.

This should take into account:

- investment is made in ETFs;

- need to track the benchmark that the fund follows (the index copied by the ETF);

- provider choice (managing company) – if there are two ETFs for a single index, while the provider of the first is large, the second is small, it is better to choose the first option;

- it is advisable to choose a fund that offers a lower commission, since in the end the costs will be lower;

- large funds manage to copy indices with greater accuracy (up to 99.8%), small ones have deviations of up to 10%;

- ETF returns are comparable to those provided by the benchmark;

- AUM – that is, the size of the fund’s assets (the larger it is, the better the index is copied).