The ability to understand and manage cash flow is considered one of the important tasks for you as a business owner if you want to be successful in business.

What is cash flow

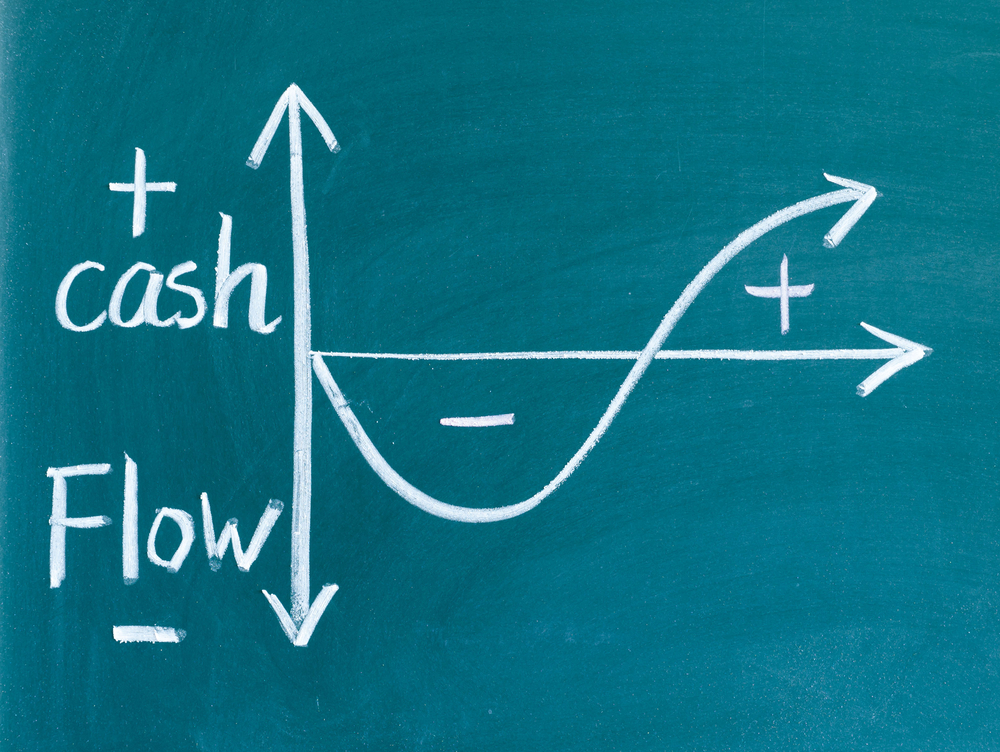

The cash flow of a business can be positive or negative. What does it really mean?

- Positive – the business receives more money than it leaves.

- Negative – the business spends more than it receives.

An easy way to properly understand cash flows is to keep in mind the total amount of money that went into and out of a bank account in one month. If at the end of the month the bank receives more money than at the beginning, then the result is positive. If there is less money at the end of the month, then this means a negative result.

The Importance of Cash Flow for SMEs

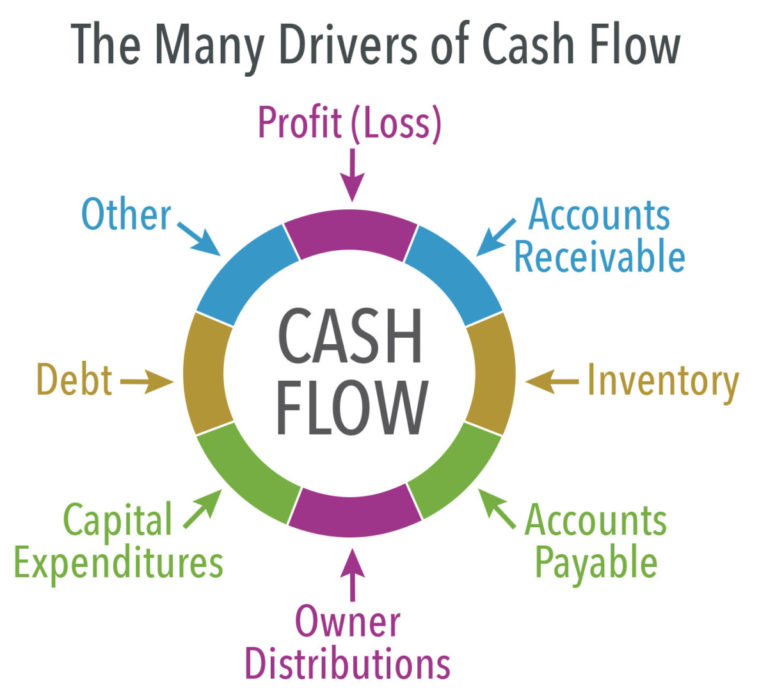

Cash flow is critical to the success of any business, but especially SMEs. Lack of free cash is one of the most common reasons businesses fail. Even the most successful business can quickly run into trouble if money is tied to overdue or unpaid bills, and the business will then no longer pay the outstanding bills.

Many entrepreneurs go through tough times when cash flow is scarce in the early days of a business. Entrepreneurs will have high costs to start their own business, but neither customers nor customers will generate the necessary revenue stream. That’s why it’s important to consider your potential cash flow situation from the outset and make sure you have access to the capital you need. It can be savings or working capital that can be obtained with additional financing. This will ensure business continuity while you wait for the money to come in.

Another important task is to keep track of cash flow, especially if the business is seasonal. If your income fluctuates greatly at different times of the year, you need to carefully monitor and manage your cash flow. In this kind of business, it can be more difficult to do so, but it is certainly possible.

Having a positive cash flow means that the business will be better prepared for possible periods of economic downturn. Cash flow management is critical to business success because it allows you to:

- Make smart financial decisions;

- Improve your own business model;

- Repay debts;

- Invest in a personal business;

- Set favorable prices;

- Define supported height;

- Return money to shareholders;

- Sales or business success plan

Common cash flow challenges faced by SMEs

Consider the most common cash flow problems for small businesses:

- Waste of money: Starting and running a business is a great experience, but some entrepreneurs spend too much money on goods and services that are not needed for direct business or will not be needed in the near future.

- Slow Bill Payments: This is a common problem faced by many entrepreneurs. To encourage faster payment, it is important to include a due date on invoices. This will increase the ability to receive payments faster and on time. And also include clear terms of payment and interest in the invoice if the client does not pay on time. If you include payment terms on your invoice, you are 1.5 times more likely to receive payment on time.

- Simplify the payment process for your customers. As much as customers want to make payments, try to make it easy for them to pay.

- Excess inventory or equipment. Having too much stock or inventory hinders cash flow and investment in other areas of the business. In addition to the initial cost of purchasing inventory and inventory, it will also be necessary to cover the running costs of storing and maintaining that inventory in its proper condition for sale.

- High overhead: High overhead is particularly difficult because it is continuous. These expenses negatively affect cash flow on a daily basis until the problem is resolved.

- Bad debt collection strategies. Often the last thing we want to hear is debt collection, but unpaid balances can seriously impact cash flow and hold back a business. Implementing a payment collection strategy and payment acceptance practices for a business will increase the likelihood that you will be paid on time or in advance.

- Overly optimistic forecasting. To reduce the risk of failure to meet the set goals, it is necessary to adhere to a conservative approach to forecasting. An optimistic forecast can lead to wasted money or poor preparation, which can leave the business extremely vulnerable and in serious trouble.

- Bad Accounting: Due to lack of time or resources, or perhaps simply a lack of understanding of the fundamentals themselves, many entrepreneurs fail to properly manage their own company’s accounting. The ability to properly organize and prepare a company’s financial statements and keep them up-to-date and accurate is critical.

While cash flow is unique to every business, it’s important to understand the general principles to know how to analyze small business cash flow so you can properly understand, manage, and improve it.

How to manage small business cash flow

Here are some common ways small businesses can get cash to avoid cash flow problems:

- Create cash flow statement;

- Estimate your income and expenses;

- Plan for the future;

- Review payment terms;

- Carefully choose people and other companies for further cooperation;

- Set expectations for clients and clearly state the consequences in contracts;

- Build strong relationships with clients.

How to maintain a healthy cash flow

Do not neglect the direction of your business and get a positive cash flow. To maintain a healthy cash flow, you need to:

- Regularly track your cash flow. As with other financial statements, it is recommended that you view the cash flow statement for each period.

- Open a line of credit for emergencies. By securing a line of credit for potential cash flow problems, you can quickly improve your cash flow situation.

- Require payment in advance. While setting deadlines for customers is one way to encourage faster payments, you can also require upfront or installment payments for larger orders. This will help reduce the amount of receivables.

A proactive approach is considered the foundation of good business cash flow management. In this way, the company’s source of income can be protected.

Healthy Cash Flow Rules

Managing the day-to-day aspects of a business along with finances and taxes can be a tedious process, leading to mistakes you simply cannot afford. Here are a few rules any entrepreneur should keep in mind in order to maintain a positive cash flow:

- Focus on cash flow, not just profits;

- The cost must not exceed the money available;

- Have a reserve in case you need to make up a shortfall;

- The faster you want to expand your business, the more money you will need;

- Choose all possible investments carefully;

- Do not overdo it with inventory and supplies;

- Don’t take out loans that you can’t repay in the long term.

You will need easily accessible money to grow your business. So one of your main goals should be to maintain a healthy cash flow.