All transactions made in the financial market are carried out with the use of securities.

In our article, we will talk about what securities are, what distinguishes them from alternatives, what types of securities are, and how they generate income.

Attributes of a security

Securities are also considered the rights to use resources with an individual material form. For example, records on previously issued accounts, paper certificates, and so on can act as securities. According to the established requirements, securities must comply with a number of parameters.

Key features of securities

- Possibility of civil circulation. Securities must have the status of available for purchase, just like they must be the object of other civil relations. They include any kind of transactions made, including loans, gifts, savings, and so on.

- Tradability on the stock market. Buying, selling or exchanging is carried out on the core stock market. All types of securities are also intended to be used as a unique independent payment instrument, which facilitates the circulation of other types of goods. The criterion under consideration makes it clear that securities can only act as a unique product, which can only be used by a specialized market with a unique scheme for creating relationships and rules for each participant.

- Seriality. All types of securities are issued not as single copies, but in classes or series.

- Standardization. This means that securities include standardized content, which specifies the terms, place of trading, rights, rules, transactions. Even the form of the document itself is standardized.

- Documentation. Given that a security acts as a document, its composition must fully comply with the regulatory requirements of the law. The parties must indicate their own details in full. If at least one item is not met, such securities will be considered invalid.

- Government regulation. The country in whose territory securities transactions are conducted is obliged to recognize them, guarantee optimal levels of regulation and a level of trust in general.

- Risk. Investing in any kind of securities always entails certain risks.

- Liquidity. If necessary, the completed purchase can be quickly realized, gaining financial profit in non-cash or cash form, and the losses for holders are insignificant.

- Compulsory execution. If the securities indicate the need to fulfill certain obligations, there is no possibility of refusing to perform the prescribed actions. As an exception, we can include cases when securities were transferred to holders in a manner not provided for by law or rules.

Purpose of securities

The primary types of securities are directly related to the need to make a payment in real money in order to increase the volume of equity capital.

In the case of derivatives, there is no direct relationship to the increase in share capital. The main task, as a rule, is to enrich the owners.

Classification

Many do not fully understand what securities are. To date, there are a large number of their categories, and they differ in a number of ways.

- Depending on the content of financial relations. In this case, securities are divided into equity (shares) that can express property relations, and debt (bonds). In this case, a loan relationship is established.

- Depending on the form of existence. There are such types of securities as paper and non-documentary. The peculiarity of the latter is that they are presented as accounting records.

- Depending on issuers. Securities include government, Russian entities or business entities. The presented category is of interest largely due to the risks associated with securities issued by various issuers.

- Depending on the method of formation. In this case, the following types of securities are distinguished: derivatives and primary. The first category includes options, futures and warrants, the second – bonds, stocks and bills.

- Based on relationship with specific holders. A choice of registered securities and bearer documents. Taking into account the fact that nominal types of securities are characterized by the difficulty of obtaining and increased control by the issuer, their liquidity is at a very mediocre level. Accordingly, the level of interest among investors is minimal.

- Depending on the circulation period. This category is divided into the following types of securities: long-term and short-term. Liquidity largely depends on the circulation period. Short-term types are characterized by the presence of minimal investment risks, and as a result, the yield is ultimately small. In the case of the second category of securities, the situation is completely different – increased income, but the risk of losing your money is also high.

Popular varieties

Most often, interested parties make transactions with the following types of securities:

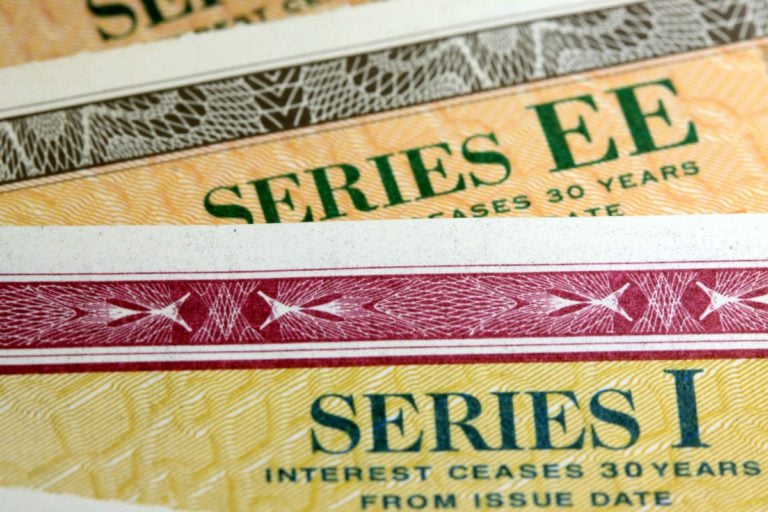

- Government bonds. Issued by the government. In most cases, they are issued for one year, and then the owner sells them back to the state, but already taking into account interest;

- Bonds. Issued by organizations. The principle is similar to the first type, only the difference between them is that in this case the release is carried out by a private organization, and not by the state;

- Promissory notes. Any person can draw up a promissory note. It is a debt obligation, the possession of which obliges to collect debts. The bill can be transferred to other persons through the standard procedure – endorsement;

- Checks. Issued by organizations. This security allows you to transfer or withdraw the amount of money specified in it. Checks are very popular in America thanks in large part to employers;

- Savings and deposit certificates. Both the first and second varieties are issued by the bank. A savings certificate is issued to an individual who has decided to make a deposit. Deposit, respectively, is intended for legal entities. Here, the maximum investment period is three years, while certificates of deposit are active throughout the year;

- Shares. Issued by organizations. Shares are the most popular type of securities today. If a share is issued by an open joint stock company, it can be freely traded on the stock exchange. Holders, as a rule, get the opportunity to vote at the meeting of the Board of Directors, as well as receive dividends. There is a preference type of shares that allows you to receive an increased percentage of dividends, but there is no voting opportunity.

There are other types of securities such as savings / bank books, bills of lading and privatization securities, but these are not very popular now.

How to make money on securities

Before making a purchase of securities, many interested parties ask the following question – what to do with their purchase in the future? Recently, the specialized markets where the issued documents are being sold have become increasingly popular.

Depending on the performance indicators, the adoption of certain decisions, the value of securities either rises or falls. Thanks to this behavior, it becomes possible to receive a good financial reward.

All that is needed is to have start-up capital and at least a little understanding of the peculiarities of the current market situation. Although the latter requirement is highly controversial.

Interesting facts about securities

- Knowing what securities are, what types of them work on the domestic market, you can get a good income. Practice shows that shares issued by large or well-known corporations are characterized by increased liquidity. Naturally, no one guarantees the absolute absence of a fall in the share price, but it rarely comes to catastrophic indicators.

- It is not necessary to have a large financial sum to start trading. In practice, a persistent myth has formed that you need to have a decent deposit in order to trade. Actually, it is not. Thanks to the active development of brokerage companies, where you can make transactions with various types of securities, the minimum deposit amount is reduced to only 5-10 dollars. Although, to get a good income, you should “enter” the market with an amount of about $ 500.

- If you do not want to study all the features of trading on your own or you do not have enough time, you can use the help of financial traders. These are people who accept investments from other participants to generate income. A trader cannot appropriate the funds for himself, he has the right only to make transactions with their help. A certain commission will be charged for winning trades, the percentage of which is set individually.