Financial management is a direction that deals with the formation of capital in a company, and also deals with the issues of its rational use in order to increase profits.

- What is financial management?

- History of financial management

- What role does financial management play in an organization

- Objects and subjects of financial management

- Goals and objectives

- Functions and Methods

- Information support

- Problems of financial management

- Performance evaluation

- Financial management benchmarks

What is financial management?

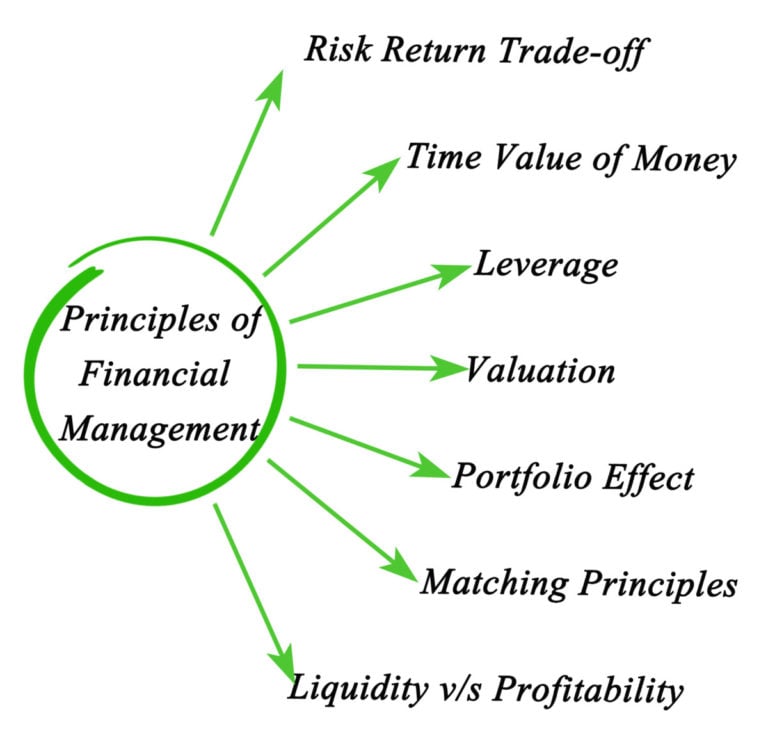

Today, financial management is a cumulative concept that consists of several areas:

- higher financial computing;

- budget analysis;

- investment analysis;

- working with risks;

- crisis management;

- valuation of the organization’s shares.

As a management activity, it is customary to consider from three perspectives:

- organization budget management;

- control;

- type of activity related to entrepreneurship.

The finances of any company are a system of economic relations inside and outside of it. In other words, the relations arising from the use of monetary resources relate to financial activities. Each budget has its own specifics, which depends on many parameters – the volume, its structure, the duration of the production cycle, costs, economic conditions and even climatic aspects.

History of financial management

Financial management begins its history in the United States at the beginning of the twentieth century. Initially, he dealt with the budgeting of young companies, later the same area included financial investments in new directions of development, as well as problems that could lead to bankruptcy.

It is believed that the first significant contribution to science was made by Markowitz. In the fifties of the last century, he developed a portfolio of tools at the level of theory. Two years later, the trio of scientists Sharpe, Lintner and Mossin, based on the developments of Markowitz, created an asset valuation method. It can be used to compare the risks and returns of a particular organization. Further work in this area has led to the creation of its range of tools that help evaluate pricing, the market and other necessary business areas.

The next stage of development was the development of Modigliani and Miller. They came to grips with the study of the composition of capital, as well as the cost of possible funding flows. In 1985, the book “The Cost of Capital” was published, which became a kind of frontier.

“Cost of Capital” reveals the theory of the portfolio of financing instruments and capital structure. In a simplified way, we can say that the book allows you to get answers to the question – where to get money and where to invest it wisely.

What role does financial management play in an organization

Financial management is a system of work with the budget of an enterprise. It, like any system, has its own methods, forms and methods of management. Any decision is made after collecting and processing the necessary information.

It is quite obvious that it is impossible to use finances effectively, and it is impossible to get them before without a well-developed system for managing them. It should be noted that financial management in an enterprise is the most important type of management, since the competitiveness and stability of a company in today’s unstable market depends on its effectiveness.

Financial management is carried out with the help of a mechanism, which in turn includes methods for the formation, planning and stimulation of work with monetary resources.

The financial mechanism is divided into four components:

- Control of the activity of the enterprise by the state.

- Market regulation

- Internal regulation.

- Techniques and methods of a specific nature, developed after receiving information and its interpretation.

Objects and subjects of financial management

Financial management as a system is divided into two subsystems – the subject and the object.

Object is what the activity is aimed at. The objects of financial management are the money of the enterprise, its turnover, as well as monetary relations between different structures of one enterprise.

The subjects of financial management – this is where any activity comes from. Namely, this is a group of persons or one manager who processes the flow of information and develops a management system. In addition, this person is responsible for monitoring and evaluating the effectiveness of the chosen strategy. Also, his scope of work includes working with investors, risk assessment and everything related to income and expenses.

Goals and objectives

Goals and objectives are two interrelated concepts. Generally speaking, the task always follows from the goal. A goal is a more global action, the achievement of which is carried out by solving specific problems. Thus, the goal has a large extent in time, and the task is small. The goals and objectives of financial management always go side by side, and one cannot be achieved without the other.

For each goal, there are usually several tasks that help to achieve it.

Financial management goals:

- growth in the value of the organization in the market;

- increase in company revenues;

- consolidating the position of the organization in the current market or capturing new territories;

- avoiding large financial outlays or bankruptcy;

- increasing the material well-being of not only the company’s management, but also employees;

- realization of the opportunity to invest the company’s budget in new areas, such as science.

Most common financial management tasks:

- The growth of the company’s market value. In order for the company’s shares to grow, it is necessary to achieve strong market positions. To do this, it is necessary to establish a competent work of financing not only the economic part. An important point is investing in profitable projects or areas. In addition, it is necessary to take care of optimizing the company’s financial affairs and attracting budgeting sources not only through its own profit.

- Optimization of the company’s financial flows. Here the problem is solved by a competent approach to solvency and liquidity. All free finances of the company should be directed to the business in order to exclude the possibility of their depreciation. In addition, this will increase profits.

- Reducing the risks associated with the loss of finances. The task is solved by developing an effective system for identifying and assessing risks. As well as the development of actions to minimize them or compensate for possible losses.

- Profit growth. The problem is solved by optimizing the use of cash flows. An important point is the competent calculations of current and non-current assets.

Functions and Methods

Financial management functions:

- organization of relations with third parties, control of relations;

- obtaining and rational use of material resources;

- methods of allocating the company’s capital;

- analysis and adjustment of the company’s cash flows.

Financial management also has strategy and tactics. Strategy is the general direction, that is, what the company is moving towards, tactics is the short-term direction, that is, how the strategy will be implemented. Processes are similar to goals and objectives. An analogy can be drawn: strategy is the formation of goals, tactics is the formation of tasks.

Financial management methods:

Based on the foregoing, there are the following methods of financial management that allow you to perform the following functions:

Planning:

- creating the financial policy of the company, setting goals for the long and short term, drawing up a budgeting plan for the organization;

- price policy creation, sales analysis, market behavior forecasting;

- tax planning

Creating a capital structure, calculating its value:

- search for budgeting needs of company divisions, search for alternative financing, development of a capital structure that will ensure profit growth;

- cost of capital calculation;

- Creating a flow of investments in such a way that the profit from them overlaps the depreciation;

- investment analysis.

Develop investment policy:

- search for growth points and investment of free finance, analysis of possible options, choice of the most profitable with fewer risks;

- development of investment instruments, their management, performance analysis.

Working capital management:

- based on projected growth points, identifying needs for individual financial assets for them;

- development of such an asset structure so that the company’s activities are liquid;

- Increased efficiency in the use of working capital.

- analysis of monetary transactions, their control and conduct.

Dealing with risks:

- search for risks;

- analysis and ways to avoid risks;

- development of ways to compensate for financial losses from risks.

Information support

Financial management cannot be effective without working with information. All information that enters the financial management department comes through two channels – internal and external. In general, the information necessary for the effective operation of the unit can be divided into several types:

- General economic development of the country (required for strategic planning).

- Market conditions, that is, the competitiveness of goods (required for the development of a portfolio of short-term investments).

- Information about the performance of competitors and counterparties (important for making immediate management decisions).

- Regulation and regulation information

- Indicators of the financial performance of the enterprise itself (profit and loss statements, the so-called P&L report).

Problems of financial management

Financial management, like any other direction of management in the enterprise, has a number of problems. In Russia, a study was conducted, on the basis of which it was possible to identify the main problems. CEOs and CFOs of more than 250 enterprises of all sizes were interviewed. Some of them include no more than 30 employees, in others the staff reaches several thousand people.

Problems faced by financial management:

- financial management and cash deficits;

- drawing up a work plan;

- financial management training;

- crisis management;

- Developing a funding strategy;

- manage expense items;

- organizational structure of the finance department;

- other financial management tasks.

Performance evaluation

Financial management is the work with the money of the enterprise; accordingly, such a type of management is considered effective, in which the profit and profitability of the enterprise grow.

You can evaluate the effectiveness of financial management by analyzing several groups:

- profitability and profitability of the company;

- business activity and return on capital;

- The market value of the company.

To obtain profitability and profitability, companies analyze several indicators:

- how effectively the company makes a profit from its core activities;

- is there enough own budget (without attracting third-party capital) to carry out activities;

- compares net income to assets on accounts (the most efficient way to evaluate);

- the profit received from the sale of goods is compared with the costs of its production and sale;

- how much profit each ruble brings.

Business activity and capital productivity show the effectiveness of the use of attracted funds and invested own finances in other areas. The profit from these actions is estimated.

Company Market Value is a measure for external companies such as partners. With its help, third-party organizations can draw conclusions about the effectiveness of the enterprise, as well as make decisions regarding the start of joint activities and partnerships.

Financial management benchmarks

At present, Western business standards have been adopted on the Russian market. The basic indicators of financial management are:

- value added;

- gross result of exploitation of investments in external sources;

- net result of exploitation of investments in external sources;

- Economic return on assets

Added value – is formed by deducting from the cost of all manufactured products (not just sold) for the reporting period the cost of services, materials and third-party organizations. This remainder is the net value added. The higher it is, the more successful the enterprise.

Gross result – salaries and all related expenses (tax and pension contributions, etc.) are subtracted from the previous indicator. This indicator shows profit without depreciation, income tax and borrowing costs. Describes how well the company conducts its financial activities. Helps to predict future development.

Net result – all costs for restoring your own balance are deducted from the previous indicator (excluding payment of interest on loans, income tax, loans, etc.). Shows the balance sheet profit of the organization.

Economic profitability – net profit with all expenses deducted, both own expenses and borrowed funds.