Company shares – a type of securities that provides a share of ownership of the company and secures the rights of the owner of the share to receive part of the profit, as well as to participate in the management of the company and to part of the property that will remain after liquidation.

- What you need to know about stocks before you start buying

- What do you need to do before trading

- How to buy company shares for a private person

- Which stocks should I buy?

- Taxation of shares

- Ways to avoid or reduce taxes

- Positive aspects of buying shares

- Negative moments in stock trading

- Which companies are the best stocks to buy

- Interesting facts about stocks

Since the value of shares is constantly changing, buying shares of companies is a good way to make money.

What you need to know about stocks before you start buying

Buying shares in companies is quite simple, because you only need to buy shares at a lower price and sell them when prices rise, thereby securing a profit. It remains only to find out which of the shares will go up and which will fall in price, for this you need to study the market in detail.

Basic knowledge to help you trade the stock market

- Chart reading is an essential part of analyzing the risks and returns of any stock. So you need to learn how to understand how the price of a stock will behave depending on the daily chart or the chart for the entire trading period.

- Knowledge of stock indices. Indices are aggregate measures of how the price of a particular security changes. In total, there are about 2,500 stock indices in the world, but first you need to know at least Russian indices.

- Knowledge in financial mathematics. These include the ability to calculate profits and expenses, calculate the relative size of income and losses. Such calculations help to compare different types of transactions in the market with respect to their income. Thus, thanks to the calculations, you can make the most profitable choice.

Information about Stocks

- In the stock market, only stock securities are traded. So, for example, commercial paper cannot be sold on the market, as they do not have sufficient unification and issue scale.

- Securities are divided into several types: main, secondary and derivatives.

- Shares, unlike other securities, are registered equity perpetual securities. They are perpetual because the shares exist as long as the company that issued them exists.

In the stock market, shares are traditionally divided into three “tiers”:

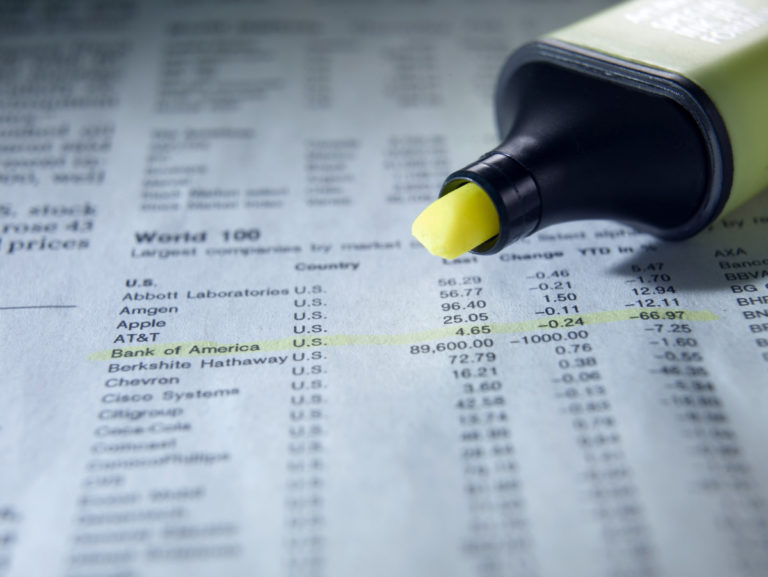

Blue chips. Such shares are the most liquid, that is, such shares are sold most of all during the day. They got this name because of the casino chips, since it is the blue chips that are the most expensive there.

Second and third tier. These include shares of small companies, but, nevertheless, listed on the stock exchanges. Often, such stocks have high growth potential, but in order to work with them, you need to have a lot of knowledge and experience in this area.

What do you need to do before trading

First you need to determine the exact amount of your starting capital and calculate the possible percentage of income. Based on the information obtained from the first point, you need to draw up a complete strategy for trading in the stock market.

Trading strategies can be:

- active;

- passive.

Active trading requires more time to conduct trading, and passive, in turn, requires certain knowledge in the field of the stock market. In your strategy, you must also decide which company’s stock to buy for the highest profit.

Before buying shares of companies, an individual must conclude an agreement with a brokerage firm. It is the broker who will carry out for you all operations on transactions with securities. But do not think that the broker will be responsible, buying shares of companies is a risky business and only the buyer will be responsible for the risks. The place where you can buy shares of companies is the stock exchange.

Things to consider when choosing an exchange and a broker to buy company shares

- Broker reliability. If you want to get high-quality brokerage services, then it would be best to contact a bank that provides such services. Banking institutions have better control, therefore, a banking broker will be the most reliable, but the cost of his services will be more expensive.

- Stock market broker experience. The length of service can be determined by the number of client accounts. If the broker has a large number of clients, then this is also a disadvantage for you personally, since the chances of an individual approach are significantly reduced.

- Cost of services. At the moment, the average commission of brokers is 0.03%. Also, most companies offer the first month of brokerage services for free. Keep in mind that commissions are paid even when the purchase of shares of companies is at a loss, so commission deductions should be minimal, otherwise you will only lose your money.

- Amount of starting capital. Each broker assigns its own amount, so before you start working, you need to clarify this point.

Which stocks should I buy?

Alexey Fedorov, Startpack — search and selection of cloud services for business:

Investing in shares of a small number of companies is too risky, history knows a lot of cases of losing investments in outwardly successful companies. I invest in the most diversified portfolios and recommend this to my friends.

Forming a portfolio on the principle of an index fund, we get minimized risks in the absence of costs for the services of managers. Learn how the index is formed, what share each of the companies occupies in it. Buy shares of these companies so that the share of your investments corresponds to the share of the company in the index. You probably won’t be able to replicate the index exactly – there may not be enough funds for all companies, some stocks are very expensive by themselves, your portfolio will have all the properties of an index fund, which is subject only to geographic risk. Similarly, you can invest in shares of foreign companies, using generally accepted indices as a guide.

European stock market

- This stock market offers its clients unlimited possibilities.

- All European exchanges are divided into several categories: Western, Eastern, Southern and Northern. All of them are almost the same, but still have some differences in the principles of operation.

- The leading European stock exchange is the London one, it is it that provides almost half of the world’s stock trading.

American stock market

- The United States of America is currently the main financial center of the world. It is the dynamics of the indices of American stock exchanges that affect stock exchanges from all over the world.

- The main exchange in America is the New York Stock Exchange.

- The American stock market is the most liquid and has a reliable system of protection. So the American markets are the most attractive for large investors.

Russian stock market

- Stock exchanges in Russia resumed their work after the collapse of the USSR in 1991. So the Russian stock market is relatively young.

- Russian stock exchanges have a high degree of profitability, but this fact is compensated by a high degree of risk.

In Russia, similarly to shares, you can invest in bonds of companies, governments, municipalities. In this case, the risks of the investor will be less than when buying shares. You can learn more about all types of bonds in the articles below:

- Federal loan bonds for individuals;

- Corporate bonds;

- Municipal bonds.

Each participant in trading in the stock markets is required to pay various taxes.

Types of taxation:

- Dividend tax. A dividend is a share of the profits of a company in which you are a shareholder.

- Income tax.

Ways to avoid or reduce taxes

- It is necessary to summarize the income and loss from operations. To do this, you need to link as many operations as possible to one brokerage account, that is, you need to open your account with only one broker.

- When transferring shares from one owner to another, you should always take a document that states the purchase price. Otherwise, you will be deemed to have purchased the shares at zero price, and therefore, on the subsequent sale of these shares, the tax will be deducted from the full amount of the sale, and not from the profit.

- At the end of the year, if there are unclosed unprofitable transactions, it is necessary to close them and buy back the sold shares. Thus, the transactions made will reduce the amount of your taxation.

- To conduct successful trading in the stock market, you do not need to have huge amounts of money. Only the amount of 500-1000 dollars is enough. This factor makes stock trading accessible to many people.

- The shares of large companies can be sold within seconds, which allows the owner of the securities to quickly receive cash if necessary, which is not the case when investing in real estate

- Today, trading in securities can be done right from home.

- The return on equity purchases can be extremely high, if done right. Since the cost of newly opened, but rapidly growing companies is extremely low.

- By purchasing a large portion of the shares, you get the right to participate in the activities of the company.

- Risks in stock trading are much lower than in currency trading.

Negative moments in stock trading

- Shares lose their value if the company that issued them goes bankrupt.

- When a crisis hits, stock prices can plummet, and it can take years to wait for stock prices to rise.

- It is impossible to know exactly the answer to the question, shares, which company is better to buy, since any shares can either rise in price or fall.

- To trade stocks safely, you need to have a large amount of cash.

- The political situation in the country in which the company is located can negatively affect the value of its shares. When investing, it is also necessary to take into account the political factor, and politics is an unpredictable thing.

- When buying ordinary shares, there is a chance that you will be left without dividends if the company made a loss.

- In order to trade stocks successfully and profitably, you need to have extensive knowledge and experience in this field, otherwise you will simply lose your money.

Which companies are the best stocks to buy

- At the moment, financial experts recommend the stocks of the largest companies, which are the most reliable option to buy.

- The stocks of such companies bring good dividends and also have constant growth, besides, the risk that you will lose your money is minimal.

- The most promising companies to buy stocks are companies with boring names. According to statistics, such companies have a large increase in shares.

- Stocks of companies that have no competitors have a high probability of rising.

Interesting facts about stocks

- During the management of Apple by Gil Amelio, the company’s stock fell to historic lows. This phenomenon was caused by the fact that an anonymous seller sold 1.5 million shares. In the end, it turned out that this seller was Steve Jobs himself, who, thanks to such fraud, again got a place in the company.

- Somalia has its own “pirate exchange”. On this exchange, people can invest their money in gangs of pirates who are engaged in robbery.

- Apple co-founder Ronald Wayne sold his stake in the company in 1976 for $800. If he did it today, he would receive $54 billion.