Whether you are just learning how to trade stocks or commodities and making enough money from this activity, or evaluating your savings, keep in mind that this really works. It’s easy if you really start doing it. It can definitely be learned.

You may want to try out more strategies, indicators, and analytics first. Over time, you will definitely find your way to earn money in the stock market. Choose simple strategies, indicators and analyzes that will bring the expected profit.

Basic Concepts

- Exchange – a legal entity authorized to organize the supply and demand of securities in a certain place and at a certain time. This is an institution that organizes the market for investment instruments. Shares, securities, dividends and interest coupons can be traded on the stock exchange. There are also many commodity exchanges around the world.

- Stock Market Index is a basic indicator that tells about market changes. Stock market indices are statistical data that serve as an indicator of the development of the market as a whole. This allows investors to follow developments over time so they can see if there is an uptrend or downtrend in a given market. One of the most famous stock indices is the Dow Jones Index (DJIA), which consists of stocks of thirty large American companies.

- Stock broker acts as an intermediary.

- A stock or investment broker acts as an intermediary in the buying and selling of financial instruments such as stocks, bonds, commodities, and derivatives.

How to make money on the stock market? Studying and searching for information

By knowing how to trade stocks or currencies, you can evaluate your finances and savings in a very interesting way. The stock exchange is a great place to value money. Thanks to your ability to regularly make money on the exchange, you can gradually create another source of income. Then you will finally be able to fulfill your dreams and desires of your loved ones. So look for information, watch videos and, for example, try different demo accounts. If you do not devote enough time to this, the results will not come by themselves. See charts, stock indices and information.

Simple rules for each market

The basis of the approach to the exchange is simplicity and the desire not to complicate things. Therefore, choose the simplest possible trading system that will allow you to easily make decisions based on the most important parameters that you set. Then it doesn’t matter if you decide to use only technical or fundamental analysis or combine them together. After all, you only need to select some features and then you will use them.

Whether the stock market rises or falls, there will always be opportunities for good trading. It is necessary to include risk monitoring in the trading rules and, at the same time, take care of the money in the trading account.

Fundamental and technical analysis

We touched on two concepts of analysis. The main types of analysis for stock trading are fundamental and technical analysis.

Fundamental examines all economic news and macroeconomic information. In this way, the economic parameters of the shares are analyzed, for example, the regular quarterly results of individual companies. Global macro analysis Global Macro tracks the development of sectors, regions and individual countries.

Currency pairs are the most popular tool for global macro analysis.

Technical analysis then predicts the change in the price of financial assets based on price movements. To do this, he mainly uses charts, with the help of which he tries to predict the future development of the price based on the past. It takes into account price changes over time and displays it in the form of charts.

Risk and wealth management

Risk and money management is another important area in stock trading. Managing risk when investing in capital markets is a key skill. Planning and use of funds within the investment is also important and plays a very important role. Only with such knowledge, you will really learn how to trade in the stock market. And the stock market can give you a chance to find financial freedom.

Follow stock market indices and look for information.

Trade and Compliance

For a marketer, the key is to control your emotions in order to achieve better results. If you manage to create and test your strategy, for example on a demo account, you will most likely make money in the market. Forget about sadness, disappointment, fear, or the insatiable desire for higher earnings. You need to learn how to trade rationally and with a cool head. It is necessary to discard emotions and learn how to receive regular income from trading on the stock exchange.

Do not trade against the trend on the exchange

Don’t try to make money on every market move. In the long run, this strategy is quite unprofitable. The reason for the failure is usually poor market entry time and high transaction costs. Short-term trading is a less certain earning option compared to the potential profit from larger market movements. Learn to swing with the current trend. On many charts, you can see that your chances of a positive result increase significantly if you follow the current trend.

Less means more

You don’t have to be active at all costs and you really want to take advantage of every business opportunity. Sometimes less is more, this rule always applies. Often you want to open another market and make money. You can easily lose sight of the fact that this entry does not match your strategy. By controlling emotions, we reduce the risk of entering a trade at a time when the market is against you.

Learn to wait patiently and avoid positions created by known events. The decision of the Central Bank to raise interest rates or the publication of preliminary results of changes in oil inventories over the past week often makes us react rather irrationally. It is much better to wait for the values and then start trading on the exchange.

Create a money management plan

The main purpose of stock trading is simply to make money. Most sellers do not have a money management plan. Focus on setting money goals and entry and exit rules. Then really follow them. Never forget to plan! This will save you from many stressful situations. Every stockbroker and trader will tell you this.

Strategy and don’t make assumptions

Don’t try to predict. The trader must decide whether to go long or short. But act only on the basis of what has already happened, not on the basis of what could happen. Stock markets often react differently than previously expected. Always count on it.

Find out, but wait. Do not make purchases based on expectations that may not be met. If a company’s merger performance is expected to improve, investors will buy shares and the price will rise, negative results often appear and shares will be wholesaled at a falling price. Enter the market guided by the trend, not the news.

Simple Rules

Set simple rules that are right for you. Don’t just accept the rules of other traders, but change them. Then it will be easier for you to follow them, even if you are not doing well. Compliance with established rules bears fruit. If you have a list of rules, review them again from time to time. Don’t be afraid to cross out and simplify. It’s easier to remember when you go through them.

Every trader knows that not every trade has to be profitable. Closing trades with a profitability of 55% or more means that your strategy is successful, the rules are well established and you are a disciplined trader.

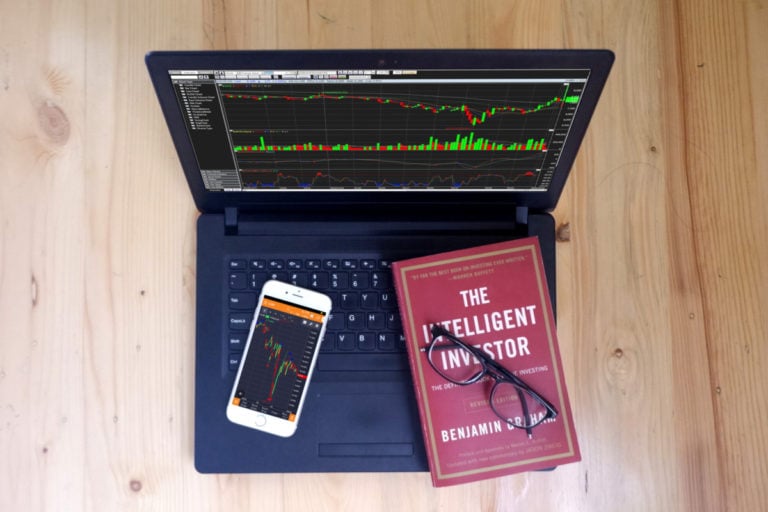

Technical equipment for online trading

To trade online on the stock exchange, you will need a computer, tablet or mobile phone and an Internet connection. Charts, price changes and everything that happens in the market can be better controlled from a classic desktop or laptop.

Price analysis using charts is a trader’s main tool and we call it technical analysis. If you want to make a living trading online, get the best equipment like backup internet, backup power supply, multiple monitors and a powerful processor. The stock market demands its own.

Amount of capital and financial leverage

Before you start trading your own money on the exchange, gain experience in trading virtual or fictitious money. Most traders offer a training demo account where you can try out various forms of trading for free. When you are good at trading fictitious money and understand how trading works, use equity. It depends on what you are trading and what strategy you choose.

Leveraged Trading

Trading with leverage is a riskier option. Choose a smaller capital and start with 20,000 rubles. Trading without financial leverage requires a minimum capital of 500,000 to 100,000 rubles. You should enter the stock market with such high capital that you can lose and not jeopardize your financial stability. Never borrow money.

If you are speculating on a long-term trend, you need more capital than a short-term trader watching intraday price changes.

Promotions or products?

You can trade stocks, stock indices or commodities such as oil, gold, silver, sugar or cotton on the stock exchange. In the past, the commodity exchange was the preserve of investors with extensive experience, but today there are countless ways to enter the commodity markets, even for non-specialists.

Select Stock Broker

You can choose a stock trader with a suitable trading platform through which you will trade on the stock exchange by trying a demo account which is free. A demo account is an investment account with fictitious money. Each broker has its own trading platform in the form of simple software that you can easily install on your computer.

You can download the trading platform on mobile phones or tablets through the Apple Store or Google Play. Technical assistance and basic training materials for the first steps in online trading are a matter of course. Check out the demo videos.

What to check when choosing a broker?

If you start investing your own money, choose a broker in advance and check it carefully. Check fees, stable trading platform, reliability, stable capital and Russian Federation accounts so you don’t have to send money outside the country. The broker must also be subject to regulatory oversight. Many brokers run seminars or webinars for free. Use them to better understand the company you plan to send money to. Get an idea of the quality of service.

Investor psychology

Once you have learned about the functioning of the market and have mastered online trading on the stock exchange on a demo account, you can safely move on to the next steps. However, on a live account, profits can suddenly turn into losses. Many traders benefit from trading fictitious money, but as soon as they switch to real money, they lose control over their emotions and decisions.

The human psyche is fragile, but it plays a key role in online trading. The time has come for rationality and composure. Most of the rules and methods work the same way when you want to invest in stocks, commodities or currency pairs. It doesn’t matter if you choose to trade on the local stock exchange or on the global capital markets.