It often happens that even people with a fairly high income do not know how to properly manage their money and, therefore, do not have financial independence.

This negatively affects the standard of living: a person cannot develop and his financial situation is unstable.

Create a financial pillow

A certain amount set aside in case of unforeseen circumstances is a necessity that every financially literate person should foresee. Many were convinced of the correctness of this approach when, during quarantine, a large number of people were left without work, without savings and found themselves in a difficult situation.

You set the size of the financial cushion yourself, however, many economists recommend saving up six wages and spending this money only in emergency situations. Thus, even in the event of a loss of a source of income, it will be possible for some period to maintain material stability and the usual standard of living and, at the same time, look for new ways to earn money.

Control your income and expenses

Discipline in this aspect will help over time to learn how to optimize expenses and save more money. Conduct a small experiment: for a month, keep a record of absolutely all expenses, and then determine what spends the most money.

The result may surprise you, since many people spend a significant part of the budget on impulsive purchases that they could easily do without, this is one of the bad financial habits. Thus, money slips through your fingers, but meanwhile, they can be used more rationally, for example, invested or set aside for more important needs.

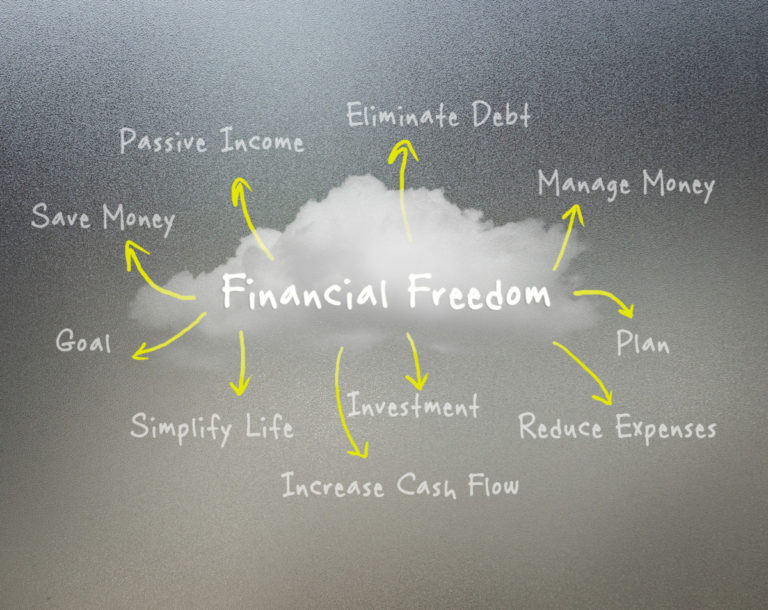

Grow your capital

This point smoothly follows from the previous one. What to do with the freed money? Make them work for you! In the modern world, almost everyone can figure out where and how to invest (in securities, real estate or other assets) correctly.

Investing some part of the capital in investments will allow you to secure another source of income, which means one more step closer to financial independence and stability.

Stop living on credit

Of course, we are not talking about those necessary things that are very difficult to acquire without taking a loan, for example, real estate. Only a small part of the population can afford to make such a large purchase at once and at their own expense.

But it is worth thinking about the advisability of acquiring less significant things on credit. For example, they include luxury items: expensive equipment, a car, etc. Also, the old Russian fun is still very popular – a wedding on credit. In the end, you pay the bank huge interest and lose your own money. We recommend that you carefully consider such transactions and, if possible, refuse loans unless absolutely necessary and live “within your means.”

Set goals

Accumulating money aimlessly is often a failed idea, so it is always necessary to form financial goals and make a plan for their implementation. At the same time, it is necessary to divide the goals into short-term and long-term, and gradually go towards the implementation of each of them.

This approach will allow you to achieve financial independence and clearly define ways to achieve your goals.