Today we will try to figure out how to analyze stocks before buying and which stocks are better to buy.

As many already know, the ideal investment portfolio should include fixed income instruments (primarily bonds for which you receive a stable and predictable coupon) and floating income instruments (these are stocks with growth potential). The proportions of these instruments in the portfolio will depend on your specific situation. Of course, the question that worries most novice investors is: How do you analyze and choose the very stocks that can take a share in your portfolio?

Unfortunately, there will be no universal recipe here, because each person must build on their investment goals. You might say, “What could be the purpose? I want to buy shares and earn”. But such a formulation of the question is very dangerous and fundamentally wrong. Don’t treat the financial markets like a magic button that prints money for you. You need to carefully select the tools and build on your situation. Investment goals will depend on: the timeframe for which you are willing to invest; from the investment amount; on your attitude to risk and much more.

There are three groups of investment goals

The first goal is to get a stable cash flow. As a rule, such papers relate to the telecommunications sector, the electric power industry, real estate fund raids on the US market. Here, you can count on understandable, predictable and stable dividends, and accordingly receive the same rental income.

The second group of goals is the sustainable growth of shares and the protection of capital. These are investors with fairly low risk taking. They are not ready to invest in companies that are at risk of extinction. Such investors are suitable for the most liquid stocks that have drawdowns that are somewhat more modest. This includes stocks in the FMCG category. And it doesn’t have to be dividend stocks. When talking about sustainable growth and protection, a company may not pay dividends or pay very little. But here the main requirement is a sustainable business that the markets like. Based on this, we expect that our capital will be protected and that the shares will grow slowly and smoothly.

The third group of goals is an aggressive increase in capital. This is a person who is ready to take risks and wants to receive high returns for this risk. Such an investor may consider companies that do not pay dividends at all and do not plan to do so, but are in a phase of early and rapid growth. Basically, these are shares from the first echelon. Here you need to understand and accept the risks for yourself. One example is Tesla and Yandex, which have skyrocketed in recent months. These companies are in the development phase.

It is clear that there can be no clear boundaries in the market that cannot be crossed. Building a portfolio is always a very creative story. But if you manage the portfolio yourself, it’s worth having two separate brokerage accounts. On one you will have papers that are not at great risk. On the other hand, there is scope for aggressive securities and for the opportunity to increase the yield of your portfolio. After determining the goal, it is already possible to proceed to the selection of specific stocks.

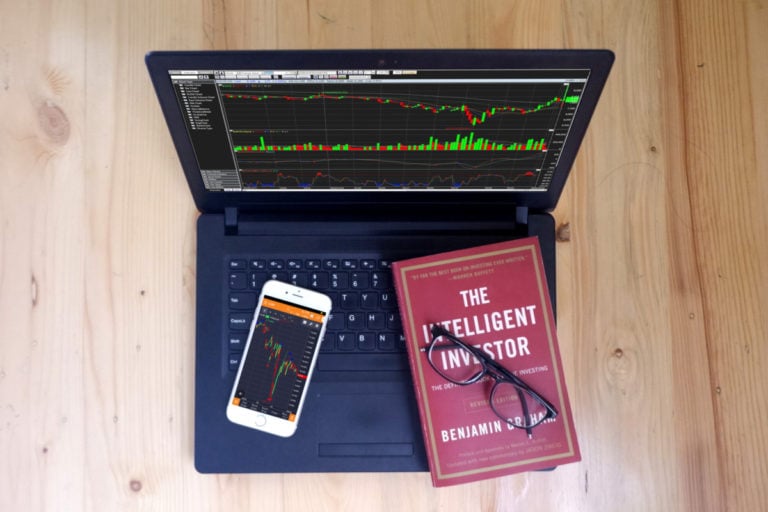

Before choosing some tickers and adding them to your portfolio, you need to conduct a qualitative analysis. To do this, you need to understand what trends in the markets currently exist, depending on your goals, which we have just talked about. It is also necessary to read financial news, expert blogs. You can use the analytics provided by investment houses and brokerage companies.

But doing this is not to find the answer to the question: “What should I do today? Should I buy a stock or not?”. And in order to be in the news flow and understand what trends are being formed now and try to predict them. Thus, you form certain arguments for yourself, based on which you will buy this or that share. Investment advisors call this the history behind the asset in your portfolio. You must explain to yourself why this stock should be yours. This is a qualitative analysis of stocks.

After you have studied the trends, understood the state of affairs in different sectors of the economy, and identified promising ones for yourself, you begin to choose suitable companies within these criteria.

How to figure it out? In fact, there are a lot of options, but there are several ways that you can use.

First, there are stock screeners. In them, you can filter stocks by a specific criterion (sector, industry) and already within the sector, you can set up different filters.

In the Russian market, ETF is not a very developed tool, unlike in America. Therefore, to view companies that operate in a narrow direction, you can go to the ETF screener and there you can already search for ETFs in a specific direction. And for specific ETFs, you will have a holding tab, when you click on it, you will see a list of companies selected in this direction.

The foundation is of course important, but you need to understand that in the short term it does not work well.

What to look out for

Firstly, if we are talking about financial indicators, then it is worth looking at them in dynamics. Ideally, 5 years for each company. After all, without a comparative analysis there will be no sense. Do not forget about IPS – earnings per share, because this is one of the most important indicators of the corporation. It is also desirable to track it in dynamics for 5 years. If IPS has been growing for several years, then this is an indicator of a good company.

It is also worth looking at the cash flows, as the company’s profit can be “drawn” (which Elon Musk is suspected of nowadays). Steady-growing cash flow is the most positive story investors can hope for. This allows the company to accumulate money on the balance sheet, buy back shares, and pay generous dividends.

Company’s income is good and good when there is positive dynamics, but do not forget about profitability in order to understand how efficiently the company works. Here you need to look at the return on assets, equity, sales, the ratio of net income to the book value of capital.

The next important point that you should always pay attention to is debt load – the ratio of debt and equity. The higher it is, the greater the risks; it shows the debt load of the company. Do not forget that too low debt is not always good, because sometimes no one lends money to a company and this does not allow it to develop.

Another indicator – net debt – debt minus cash and its equivalents on the company’s balance sheet. In a sense, this multiplier is more revealing. Since there are companies that have plenty of money, but for certain reasons they attract borrowed funds (place gangs), and this is not always a bad thing.

You also need to know about dividend yield and absolute payout. We need to look at how long the company has been paying dividends, how stable they are, and whether it is able to increase dividend payments. However, there are extraordinary situations, like the crisis of 2020 or 2008, when many responsible companies were forced to cut dividends.

It is worth paying attention to forecasts of future dividend payments from the company itself or from analysts, but on the other hand, dividends are not the only factor to rely on if your goals are not purely passive income.

There are also companies that, after being on the market for a long time, do not pay dividends (Facebook), but at the same time actively invest and buy startups.

The next question you can ask is “Should I look at a chart and use technical analysis?”. It’s up to everyone here. You can look at the chart, you can look at certain levels, you can build trend lines, but many investors consider the use of various indicators to be inappropriate. On the charts, you should look at reversal patterns.

Such a table can easily be left in excel, you can use stock screeners, since many of them offer us the opportunity to conduct a comparative analysis by company.

This is exactly what a theoretical educational program looks like on the fundamental analysis of stocks and their selection in a portfolio. It turned out not very briefly, but now the main directions have stood out.

A couple of tips

Do not hurry. First of all, do not rush to look at a particular multiplier, on someone else’s advice. This strategy is very superficial and the market does not like such superficiality and often punishes for it.