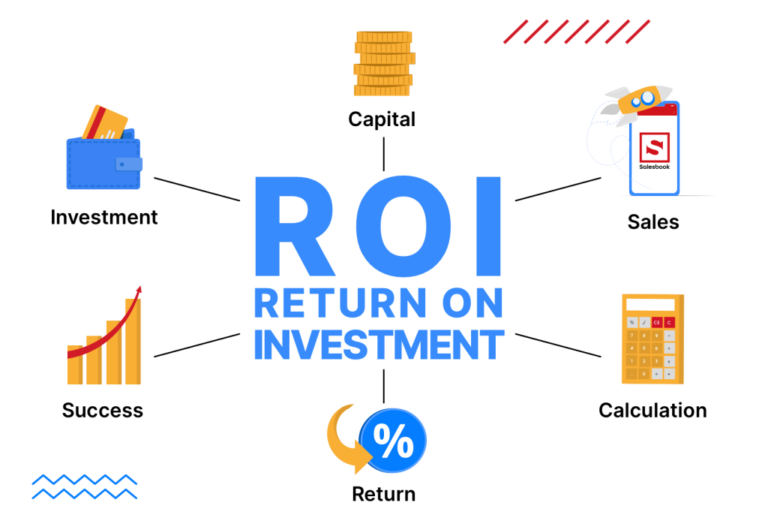

What is the financial leverage effect and why is it important for business development?

The presence of raised funds in the company's resource planning is explained by the fact that, as a rule, the company does not have enough to implement more or less significant investment projects your own resources.